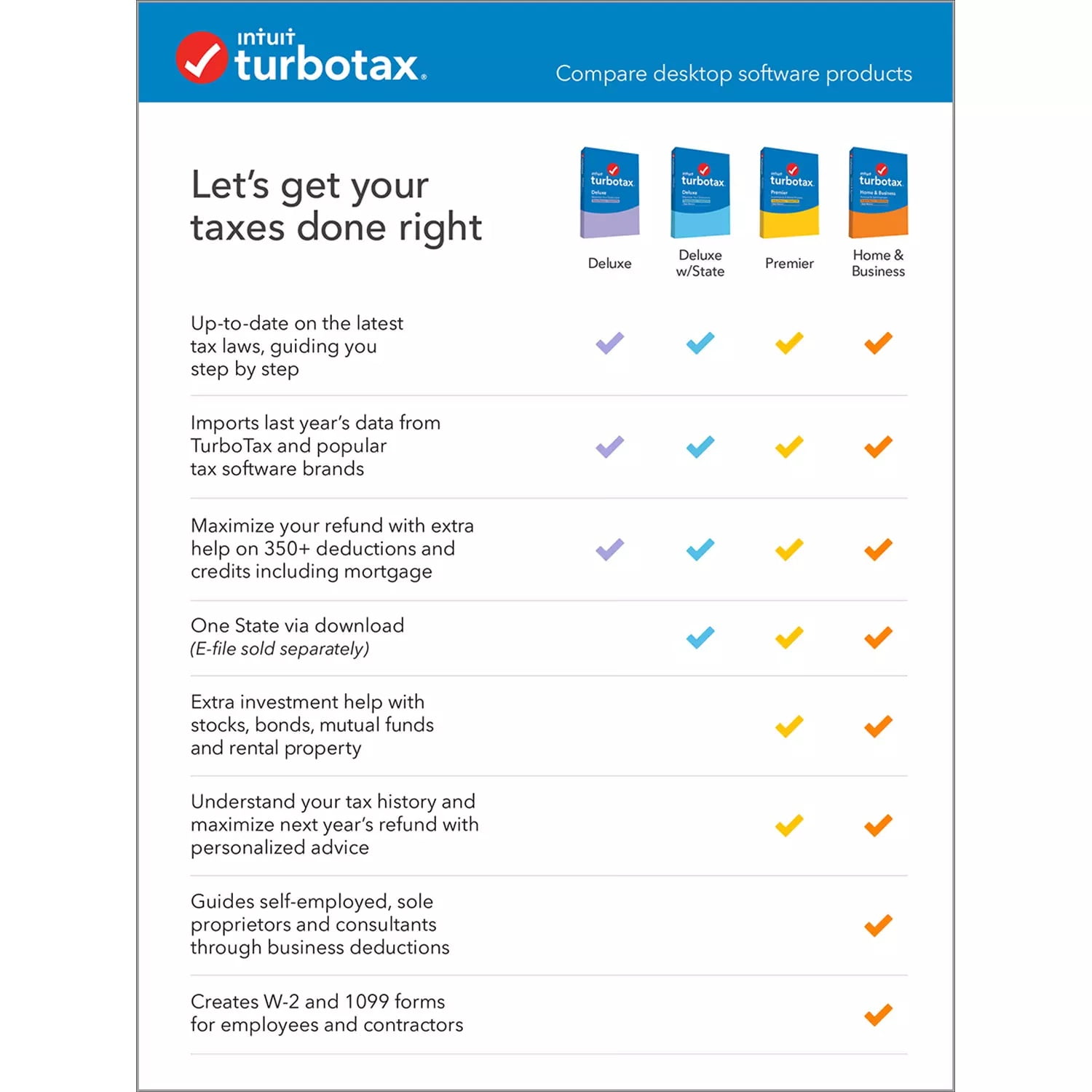

Your information is safeguarded - TurboTax uses encryption technology, so your tax data is protected while it's e-filed to IRS and state agencies. Help along the way-get answers to your product questions, so you won't get stuck. Up-to-date with the latest tax & healthcare-related laws-so you can be confident your taxes will be done right. As a returning customer, TurboTax will automatically transfer last year's data to help ensure accuracy and save you time. TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you're getting every dollar you deserve.Įvery year it gets even easier. TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you're confident you'll get your maximum refund.

Get your taxes done right with TurboTax 2017

The last day to file in time to claim your money is May 17, 2021.Learn more about the TurboTax Deluxe 2017, Federal with State + Efile for Windows - Download Model Brand If you're late on filing your 2017 taxes, you still have time to do so. Refundable Credit For Prior Year Minimum Tax.While filing taxes from past years seems like a hassle, non-filers from 2017 may want to consider turning in their tax return - even if they aren't required to according to their income level - since they could be missing out on tax credits and other money.Īccording to TurboTax, non-filers forgo the chance to receive the Earned Income Tax Credit (EITC), since the only way to get it is to file a tax return. This might include people who earned below the minimum income levels in 2017 and were not required to file taxes, or those who missed the deadline for other reasons. The IRS gives a maximum window of three years before you lose out on your unclaimed return. Typically, if you skip your taxes one year, you can file for an extension and file late.

The IRS reports there's still roughly $1.3 billion in unclaimed tax refunds for those who didn't file a return in 2017.

0 kommentar(er)

0 kommentar(er)